Jamuna Oil’s profit hits all-time high on margin hike, interest gains

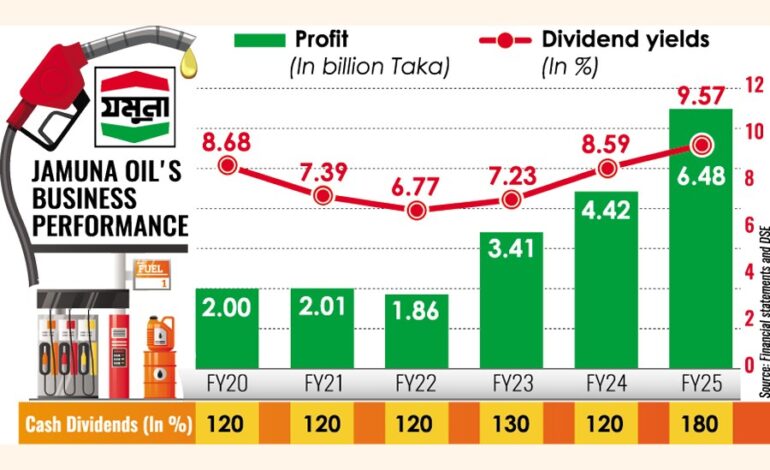

Jamuna Oil Company earned a record profit of Tk 6.48 billion in FY25, supported by higher sales margins and substantial income from bank deposits.

The state-run oil distributor registered a 47 per cent year-on-year growth in profit for the year ended in June this year, according to a stock exchange filing on Thursday.

The government raised the margin on fuel sales by 60 per cent to Tk 0.80 per litre for the three state-owned oil marketing companies, including Jamuna Oil, while the margin on octane and petrol rose by 50 per cent to Tk 0.90 per litre in March last year.

The record profit prompted the company to declare its highest-ever cash dividend – 180 per cent – for FY25, up from 150 per cent paid for the previous year.

Investors will receive Tk 18 per share from the yearly income of Tk 58.70 per share, meaning the company will distribute only one-third of its profit as cash dividends to shareholders for the year.

Due to higher dividend declaration, its dividend yieldis estimated to be a record high of 9.57 per cent for the year.

Although the sales margins rose, the state-owned fuel oil marketing companies — Jamuna Oil, Meghna Petroleum and Padma Oil— rely heavily on income generated beyond their core business operations to maintain profit growth.

Market analysts said they have huge amounts of bank deposits (FDRs) and earn significant income from such investments.

The company is yet to publish detailed financial data for FY25, such as total sales, interest income, or non-operating income.

However, its nine-month sales rose 34 per cent year-on-year to Tk 1.24 billion through March this year. Operating income jumped five times year-on-year to Tk 3,365 million during the same period, while non-operating income surged around 36 per cent to Tk 5.54 billion, owing to rising interest rates.

Sales revenue increased as demand for fuel grew during the year, alongside a higher sales margin. At the same time, interest income rose in FY25 compared to the year before, as banks offered higher deposit rates.

Interest rate has been in an upward momentum since the government removed the ceiling on lending rate and the rate further rose when the government stopped controlling it and left it to the market in May last year.

Jamuna Oil had investments worth Tk 13.34 billion in short-term instruments while long-term investment was Tk 8 billion as of March this year, according to its financial statements.

The growth in interest income indicated that the company had set aside funds to generate interest income instead of distributing a higher cash dividend.

The company’s annual general meeting (AGM) will be held on January 31 next year and the record date for entitlement of dividends is December 24 this year.

Despite the latest disclosure, the stock dropped 0.11 per cent to Tk 186.8 each share on Thursday on the Dhaka Stock Exchange (DSE).

Q1, FY26 results

Jamuna Oil’s profit for July-September this year also rose 19 per cent year-on-year to Tk 1.48 billion, again supported by non-operating income.

The net operating cash flow per share became negative Tk 35.50 for the July-September quarter as opposed to positive Tk. 55.58 per share for the same quarter the year before, due to an increase in inventories and trade receivables.

https://thefinancialexpress.com.bd/stock/bangladesh/jamuna-oils-profit-hits-all-time-high-on-margin-hike-interest-gains